Ghana’s cedi is defying expectations, emerging as one of the best-performing global currencies this year despite seasonal trade headwinds and a slowdown in remittance inflows, according to the country’s central bank chief.

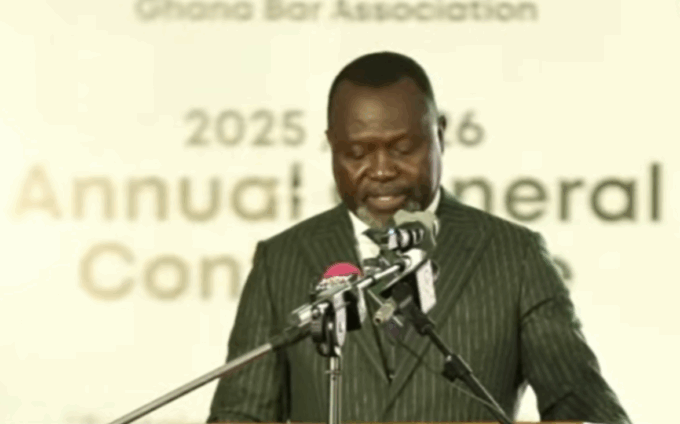

Speaking at the opening of the Bank of Ghana’s Monetary Policy Committee meeting on Monday, Governor Dr. Johnson Asiama said the cedi has appreciated roughly 21% year-to-date as of Sept. 12, buoyed by improved foreign-exchange buffers, robust exports, and tighter monetary oversight.

“Despite the seasonal pressures and a slowdown in remittance inflows in recent weeks, the cedi remains one of the strongest currencies globally,” Dr. Asiama said.

Remittances—a key source of foreign exchange for the West African nation—have softened compared to previous periods, he noted. Still, the broader impact on the local currency has been contained thanks to strong fundamentals and proactive policy measures.

Ghana’s external position has improved markedly. The country recorded a trade surplus of $6.2 billion over the first eight months of 2025, driven by higher gold and cocoa export earnings. As of August, gross international reserves stood at $10.7 billion, equivalent to approximately 4½ months of import cover.

The cedi’s performance now ranks alongside global currencies such as the Russian ruble, Swedish krona, Norwegian krone, Swiss franc, euro and the British pound, Dr. Asiama said.

Currency strength has translated into softer import costs, helping to ease inflation and lowering the financial burden on import-reliant businesses. But analysts caution that the cedi’s momentum will hinge on sustained export growth, steady remittance flows, and containment of risks tied to volatile commodity prices.

Dr. Asiama emphasized the central bank’s readiness to act if conditions deteriorate. “The Bank of Ghana will remain vigilant and intervene when necessary to maintain currency stability,” he said.