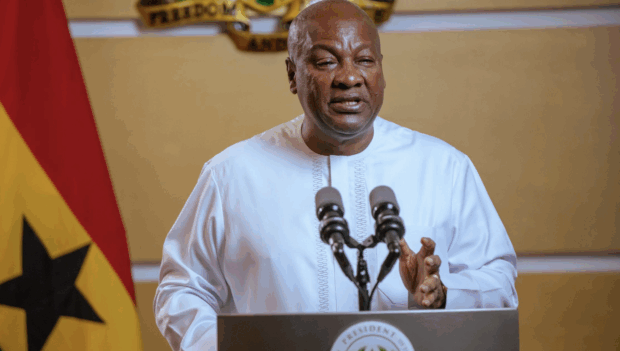

Ghana’s new government, led by President John Mahama and backed by a strong parliamentary majority, has a renewed chance to push through ambitious economic reforms, according to the World Bank Group’s 9th Ghana Economic Update.

The June 2025 report highlights that while the country’s political stability provides a solid foundation for reform, Ghana must also prepare for slower growth as fiscal consolidation measures take effect.

The World Bank said the administration’s reform agenda focused on fiscal discipline, macroeconomic stability, and long-term growth has been given significant momentum by its electoral mandate. However, it warned that delays in implementing institutional and legislative changes could trigger fresh fiscal pressures and weaken investor confidence.

The Bank projects Ghana’s economy will expand by 3.9% in 2025, a slowdown from the 5.7% growth recorded in 2024. This deceleration is largely due to strict fiscal adjustments, persistent inflation, and elevated interest rates. Nonetheless, these measures are seen as necessary to stabilize the economy and unlock a sustainable long-term growth potential of about 5%.

Despite the slowdown, several sectors are expected to remain resilient:

• Gold Exports: High international prices will keep export earnings strong, providing crucial foreign exchange.

• External Sector: Ghana’s external accounts are projected to post a surplus, supported by robust exports, steady remittances, and sustained foreign direct investment. The Bank of Ghana recently reported that remittances contribute more than $4 billion annually, making them vital to the economy.

• Inflation: The report expects inflation to ease further as the Bank of Ghana continues its tight monetary policy stance.

On the fiscal front, the government is targeting a primary surplus of 1.5% of GDP in 2025, creating room for investment in pro-growth and social programs. The World Bank assesses Ghana’s debt as sustainable in the medium term, provided two key conditions are met: the completion of external debt restructuring and full adherence to fiscal consolidation plans.

While the risk of debt distress remains high, significant progress has been made, with an agreement already secured with official creditors. Looking ahead, Ghana’s borrowing strategy will focus mainly on domestic sources, with a cautious return to international markets expected only in the medium term.