A sharp surge in the value of Ghana’s cedi has triggered an unexpected consequence: a nearly 50% drop in remittance inflows from Ghanaians abroad, according to Bank of Ghana Governor Dr. Johnson Asiama.

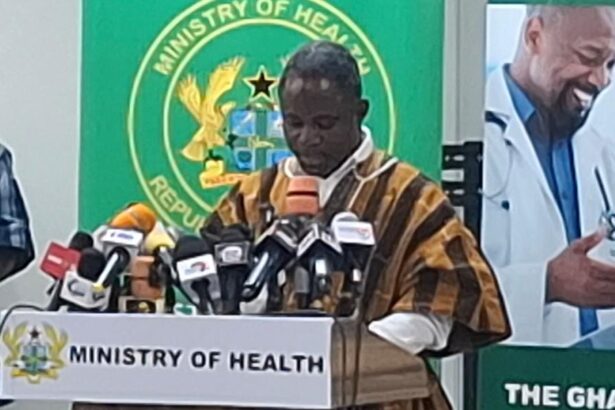

Speaking Tuesday,August 5,at the launch of the Bank of Ghana Chair in Finance and Economics at the University of Ghana, Dr. Asiama said the cedi’s appreciation—driven by macroeconomic stabilization, declining inflation, and stronger external reserves—has led many in the diaspora to hit pause on sending money back home for projects.

“The appreciation of the cedi so far, Ghanaians are interpreting this differently, and it is part of the problem,” Dr. Asiama said. “People who used to send remittances for projects have suddenly stopped.”

Remittance flows—historically a key source of household income and foreign exchange—have fallen by nearly half, he said, even as the local currency has strengthened more than 40% against the U.S. dollar, 31% against the British pound, and 24% against the euro this year.

While the cedi’s surge signals improving investor confidence, it’s also reshaping financial decisions in Ghana’s global diaspora. With exchange rates now offering less local currency per dollar or euro sent, some expatriates appear to be deferring construction and other investments until they perceive better value.

“By the way, if you are doing projects in Ghana, cement prices must also adjust, not so?” Dr. Asiama said, pointing to falling inflation as a counterbalance. “On the balance, it shouldn’t matter.”

Still, the central bank chief suggested that more direct engagement with the diaspora may be needed to reverse the trend. “Someone told me this morning, we need to do a roadshow across the top remittance-originating countries… to explain to them to continue sending their monies regardless of where the exchange rate is,” he added.

Ghana’s remittances have historically played a stabilizing role in household consumption and housing development, and a sustained decline could ripple through sectors of the economy that rely on diaspora financing.